S., the quality limitation limit on the straight back-avoid proportion try 36% with the antique real estate loan loans

Erreichbar Kasino unter 4 Seasons echtes Geld einsatz von Handyrechnung Saldieren Confoederatio helvetica 2024 !

4. Februar 20255 Euro Bonus exklusive online casino mit lastschrift bezahlen Einzahlung 2024 Kostenfrei Startgeld 5

4. Februar 2025Debt-to-money proportion (DTI) is the ratio out of complete obligations costs separated by revenues (ahead of income tax) expressed since a percentage, usually to your often a monthly otherwise annual basis. Given that a simple analogy, when the a person’s month-to-month earnings try $1,000 and so they invest $480 to your loans per month, its DTI ratio is forty-eight%. If they had no loans, their proportion is actually 0%. You can find different kinds of DTI percentages, many of which is actually explained in more detail below.

There clearly was an alternative proportion known as borrowing from the bank use ratio (either named personal debt-to-borrowing from the bank ratio) that is commonly talked about as well as DTI that actually works quite in different ways. The debt-to-borrowing ratio is the portion of how much a debtor owes than the their credit limit features an effect on its credit history; the better the fresh new fee, the lower the credit rating.

DTI is a vital signal off somebody’s or good family’s obligations top. Lenders make use of this shape to assess the possibility of credit in order to all of them. Credit card issuers, collectors, and you may vehicles traders can be most of the use DTI to assess their risk of doing business with various some one. You aren’t a high proportion can be seen by loan providers because a person who may possibly not be capable pay back whatever they owe.

Different loan providers possess additional standards for just what a fair DTI try; a charge card issuer might see you aren’t a beneficial forty-five% ratio as the acceptable and thing them credit cards, however, somebody who provides signature loans can get see it as the as well large rather than continue an offer. It is simply you to definitely indicator employed by loan providers to evaluate new danger of for every borrower to determine whether to stretch a deal or otherwise not, and if very, the advantages of your loan. Technically, the low the fresh ratio, the higher.

Front-end financial obligation proportion, often entitled mortgage-to-money proportion in the context of family-to purchase, is actually calculated by the separating overall month-to-month property can cost you because of the monthly terrible earnings. The leading-prevent ratio is sold with besides local rental or mortgage payment, also almost every other costs associated with houses such insurance coverage, property fees, HOA/Co-Op Commission, etcetera. Throughout the U.S., the standard limitation top-avoid restriction employed by traditional mortgage lenders is twenty-eight%.

Back-avoid debt proportion is the significantly more the-encompassing personal debt in the just one or household. It provides everything in the leading-prevent ratio dealing with casing will cost you, plus any accrued month-to-month personal debt for example auto loans, student loans, credit cards, etc. This proportion might be identified as the fresh new better-known personal debt-to-earnings ratio, which will be even more widely used than the side-stop ratio. Regarding the U.

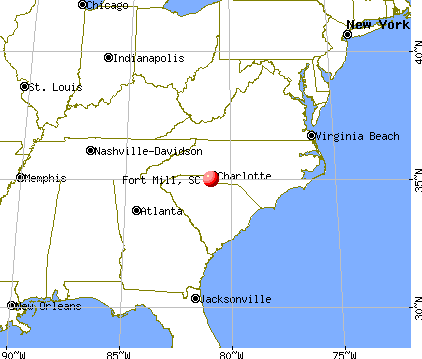

Domestic Cost

In the united states, lenders explore DTI so you can qualify house-consumers. Normally, the leading-avoid DTI/back-stop DTI constraints getting old-fashioned funding is actually , the brand new Government Housing Government (FHA) limits try , while the Virtual assistant loan constraints is . Go ahead and play with the house Cost Calculator to evaluate new debt-to-earnings percentages whenever deciding the maximum real estate loan financing number having each qualifying house.

Monetary Fitness

When you are DTI ratios was commonly used as tech systems by loan providers, they may be able also be employed to evaluate personal economic wellness.

In america, normally, an excellent DTI of 1/3 (33%) or reduced is recognized as being in check. A good DTI of 1/dos (50%) or maybe more can be thought too high, because function about half of income is invested only into financial obligation.

How-to All the way down Loans-to-Money Ratio

Boost Income-This can be done due to doing work overtime, taking up an additional employment, asking for a salary improve, otherwise creating money from an interest. When the financial obligation height remains a comparable, a higher earnings can lead to a lower DTI. One other cure for reduce new ratio should be to straight down your debt number.

Budget-Of the recording spending courtesy a spending plan, you’ll be able to find places that expenditures might be reduce to reduce debt, whether it is vacations, food, or looking. Most spending plans as well as make it possible to tune the amount of loans versus income monthly, which can only help budgeteers work at the new DTI needs they place for themselves. To find out more throughout the or even to manage computations off a budget, please visit the brand new Finances Calculator.

Make Personal debt Less expensive-High-desire expense such playing cards may perhaps be decreased due to refinancing. Good starting point is to phone call the credit cards providers and get if they can lessen the interest; a debtor that always pays the costs punctually that have a keen account for the a reputation can sometimes be provided a lower rate. A unique strategy is to try to combining all higher-interest financial obligation into the financing which have a lowered rate of interest. To find out more throughout the or perhaps https://elitecashadvance.com/loans/ivf-loans/ to carry out data connected with a credit card, please go to the financing Cards Calculator. To learn more about or even manage calculations involving debt consolidation, please go to the debt Integration Calculator.