- Lengthened closure times compared to the FHA and old-fashioned

- Stricter assets criteria than traditional

FHA mortgage: These types of loans don’t possess people earnings limits otherwise ineligible geographic portion. They want 3.5% down. Deposit and you may settlement costs will come out of something special of a down-payment guidelines system.

Virtual assistant loan: Readily available simply to those with qualified military sense, always 2 yrs off energetic-obligation services. To own qualified homeowners, it has zero off and very lowest mortgage rates.

Old-fashioned loan: Financing that requires only step 3% off. These are good for consumers with a high credit ratings and solid earnings.

Kansas first-day homebuyer features and you may applications

The new Kansas Homes Financing Department gives the Your decision! Deposit Advice system in which buyers normally discover often dos.5% otherwise 5% of purchase price for the the downpayment and you can/otherwise settlement costs.

The assistance might be in conjunction with a beneficial USDA loan, otherwise FHA, Va otherwise Antique. For folks who keep up with the household and mortgage to own eight decades, the support number was forgiven. Money and assets price limitations use.

USDA mortgage credit score minimal

Really USDA lenders implement her minimal on system. This is why you should check around. If one financial rejects the application, talk to another.

USDA mortgage insurance rates

Make certain fee: An upfront fee comparable to 1% of your own loan amount. You could potentially fund this percentage toward mortgage.

Annual fee: That it percentage means 0.35% of the a fantastic mortgage equilibrium a-year. You pay step one/twelfth of yearly fee every month with your normal mortgage repayment. This adds on the $30 monthly on commission for every $100,000 borrowed.

This type of charge go into retaining the program and you may therefore it is offered to have coming homebuyers. Partly just like the prior USDA consumers paid back the price tag, the program is obtainable to cause you to a homebuyer as well.

USDA Guaranteed compared to Head financing

Guaranteed loans portray a lot of USDA financing. You have made these off a mortgage organization otherwise bank, not the government itself. He is to have average-income earners. This article is talking about this new Secured system, not the brand new Head system.

Head USDA loans is to possess properties that have lower and extremely lowest income. This can be identified as $29,550 $fifty,five hundred annual money in the most common elements. These types of fund is actually issued because of the authorities service by itself and you may come that have more strict laws and regulations. For more information concerning the Lead system, see USDA’s web site.

USDA loan providers, the process, and the ways to pertain

These types of funds incorporate a somewhat some other process compared to FHA and you may antique. They must be twice-accepted, in such a way. Following the bank approves the file, it needs to be delivered to possess opinion to USDA alone. This will need a number of most weeks if not months, depending on how copied new USDA work environment are. You can observe most recent USDA turn moments here.

Yet not, your own sense will be the same as delivering every other mortgage loan. The lending company protects the additional step away from giving it so you can USDA.

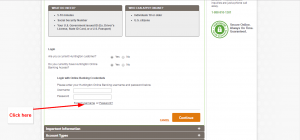

- Implement to your bank.

- Complete all your files.

- Look for and also make a deal into the property, and get a recommended offer.

- The lender commands an appraisal and you can finalizes the brand new approval on the end.

- The lender after that directs the brand new file to help you USDA to own approval.

- Abreast of USDA recognition, the lender pulls latest financing records.

- Your sign records.

- The loan closes and you get the important factors.

Kansas USDA loan FAQ

The cash restriction for most parts inside the Kansas to have 2022-2023 are $103,500 for one-cuatro affiliate homes and you my review here can $136,600 for five-8 associate properties, and higher in a number of portion dependent on average earnings.

]]>