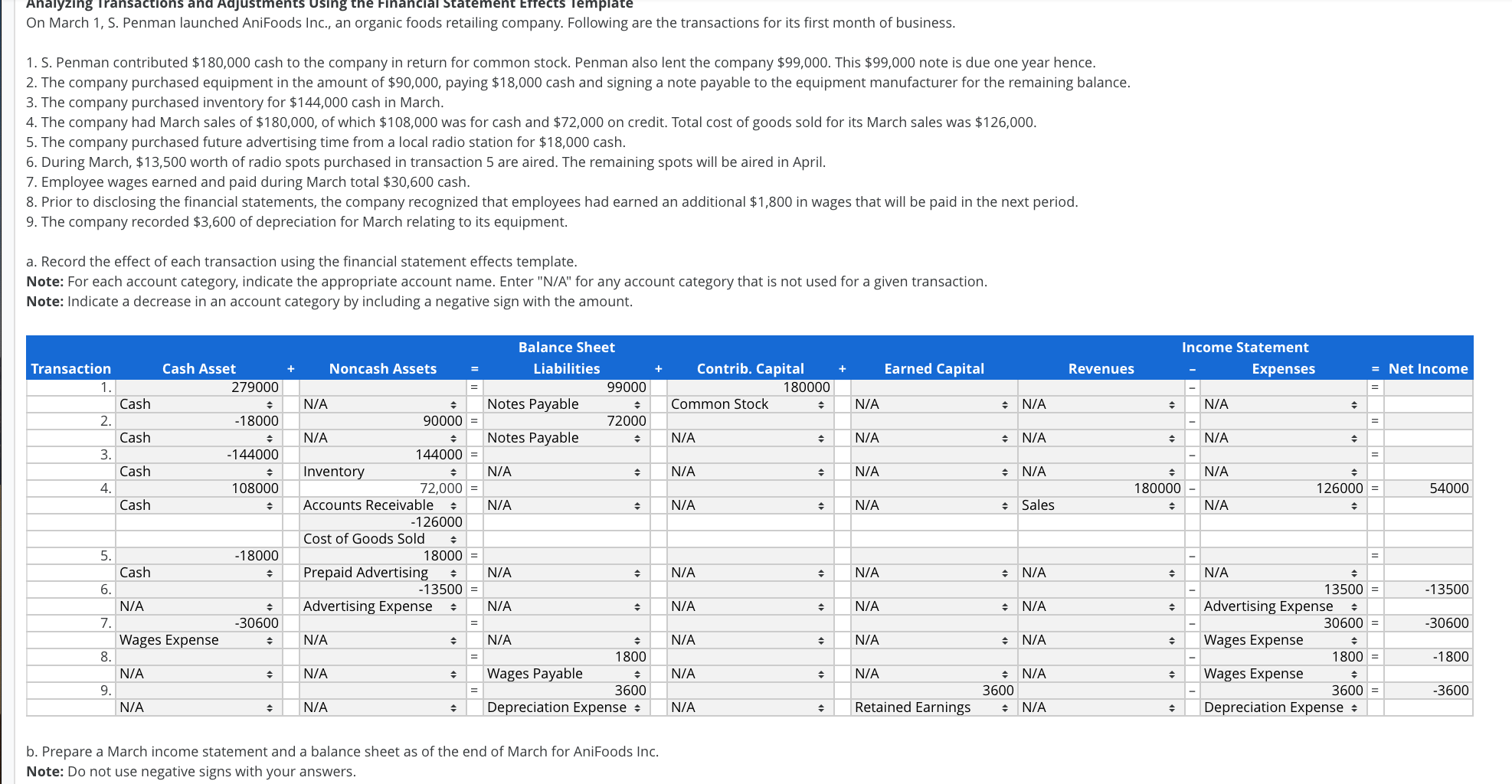

Navy Government Credit Union Home loan See home loan cost in your area of using partners at the Bankrate Insider’s Rating A five pointed celebrity Symbol of glance at p This means a verified options.

Perks Charge a 1% origination payment, but you can waive it in return for a home loan rate that is 0.25% higher

Have a look at mark symbol A mark. This means a verification of your own designed telecommunications. con symbol A couple crossed contours that setting an ‚X‘.

It’s recommended for all those associated with the newest army full, especially if you’re looking to quit and then make a down payment. Nevertheless lacks visibility doing the credit history requirements.

- You are entitled to a mortgage whenever you are an active military representative, veteran, family member of somebody affiliated with the new military, Agencies away from Coverage civil, otherwise housemate out of an existing Navy Federal member

- Branches around the Us and on United states military basics abroad

- Army Alternatives financial try a thirty-seasons financial to have military players with no minimal down payment; Homebuyer Choice mortgage try a 30-season financial for those who never be eligible for Virtual assistant fund having no minimum down payment

- Pertain having low-old-fashioned borrowing research, eg research you spend electric bills

- Alive support service 24/7

Demanded Borrowing Undisclosed Version of Funds Given Compliant, Va, jumbo, Army Possibilities, Homeowners Possibilities, domestic equity financing, HELOC

Navy Federal is a great choice for some body connected to new armed forces, so we think its a particularly a good financial for first-go out buyers, since it also offers numerous zero-down-commission mortgage choices.

Navy Federal has the benefit of several affordable mortgage loans beyond the Virtual assistant loan, also a homebuyers Choice mortgage, which is a normal loan without advance payment requisite and you may zero financial insurance. So it financial also welcomes solution borrowing from the bank data, eg bills, if you don’t have a classic credit rating.

Navy Government gotten a leading get out-of J.D. Strength, but don’t rank throughout the annual client satisfaction research because cannot see particular criteria. Predicated on HMDA analysis, the fresh Navy Federal’s average fees was reduced compared to the almost every other lenders.

Navy Federal Borrowing Relationship is among the most our very own greatest Va financial lenders

What things to be cautious about: Navy Federal keeps a keen NR (No Rating) regarding Better business bureau because it’s in the process of replying to in the past closed complaints. You could simply become a member of Navy Federal Credit Commitment if you or all your family members is actually associated with the army, youre a department regarding Coverage civilian professionals otherwise contractor, or you accept a great Navy Federal representative.

Perfect for student loan individuals You.S. Lender Mortgage Into Bankrate’s site Insider’s Rating A five pointed celebrity Demanded Credit Minimum Advance payment Types of Fund Offered

Examine mark symbol A check mark. It https://cashadvanceamerica.net/personal-loans-me/ indicates a confirmation of your own implied communications. swindle icon Several crossed contours that form a keen ‚X‘.

You.S. Bank is amongst the better mortgage lenders having basic-date buyers. It has a whole lot more style of mortgage loans than simply extremely lenders, therefore it is a good option for the majority of borrowers.

- Has the benefit of home loans in all 50 U.S. says and you can Washington, D.C.

- Have financing officials for the 42 states

- Minimum credit history and you can down-payment exhibited is actually to have compliant mortgages

U.S. Lender is a good selection for education loan borrowers compliment of their American Dream Loan, that is geared toward lowest-income individuals. U.S. Financial states it can run education loan borrowers for the money-inspired installment plans for this mortgage.

You.S. Bank’s American Dream Financing includes good 3% deposit, no mortgage insurance coverage, therefore lets non-antique borrowing if you don’t have a credit rating. you will wake-up to $ten,000 in deposit and you will closure costs advice about this home loan.

]]>Secure home financing once the a senior citizen

If you are an older just who hinges on Social Defense as your number one revenue stream, the notion of securing home financing will likely be challenging.

not, you will find lenders to own seniors towards the Societal Safeguards specifically made to get to know your unique monetary needs. This can be eg relevant for the majority of retired people and you can seniors wanting to purchase a secondary family, downsizing, otherwise tapping into their home collateral.

Thank goodness, the marketplace also provides various home loan alternatives for the elderly with the Personal Protection, and you may here’s what you have to know.

- Older mortgage brokers

- Qualified money offer

- Senior home loan choices

- Elderly home loan options

- FAQ

Can an older rating home financing?

Yes, seniors to the Societal Cover can get a home loan. Societal Security Earnings (SSI) to have senior years otherwise enough time-name impairment can certainly be used to help qualify for a good mortgage loan. Which means you could more than likely purchase property otherwise re-finance established toward Personal Defense positives, while you’re currently finding them.

Type of income considered having older mortgage brokers

When making an application for a mortgage loan, loan providers generally speaking evaluate several kinds of money to determine your capacity to pay the mortgage. Here http://cashadvanceamerica.net/personal-loans-ct are some types of earnings that’s essentially recognized so you’re able to be eligible for a senior home mortgage:

Mortgage options for seniors towards Social Protection

Retirees and you will seniors take pleasure in a wide range of home loan selection. Past products like old-fashioned mortgages and you will asset exhaustion fund, there are certain regulators home loans getting the elderly with the personal security. They’re FHA, Va, and you may USDA finance.

Simultaneously, condition and you may regional homes providers commonly offer certified lenders getting the elderly that feature versatile being qualified criteria and you may it is possible to assistance with down costs and you may settlement costs.

Since prior to now indexed, seniors with sufficient assets, senior years deals, otherwise capital profile can easily defeat the income standards to own home loan recognition. Here are certain commonly found lenders getting elderly people toward Public Coverage or any other money provide.

Antique funds is a popular selection for of numerous borrowers. Lenders fundamentally consider Social Cover money to get credible, allowing elderly people in order to be considered. Although not, this type of fund have a tendency to require a good credit score, a reduced financial obligation-to-earnings proportion, and often a hefty advance payment so you’re able to secure positive terminology.

Federal national mortgage association senior property system

Fannie mae has actually procedures that enable qualified old age possessions to be always qualify around specific standards. They lets lenders play with an excellent borrower’s old age possessions to enable them to be eligible for a home loan.

If for example the borrower has already been playing with an excellent 401(k) or any other retirement money, they will certainly need certainly to reveal that the money received will continue to have about three years. At the same time, they’re going to need certainly to render documentation appearing the bucks becoming pulled out-of the latest membership.

Whether your debtor however should start using the brand new resource, the lender normally compute the amount of money load you to definitely house could offer.

Freddie Mac elder real estate system

Likewise, Freddie Mac altered the financing recommendations to make it more relaxing for individuals in order to be eligible for a home loan with limited income, but substantial possessions.

The new rule allows lenders to take on IRAs, 401(k)s, lump sum payment retirement account withdrawals, and arises from brand new sales off a business in order to be eligible for a home loan.

People IRA and you will 401(k) assets need to be totally vested. They want to be also totally open to the brand new borrower, maybe not subject to a detachment penalty, and never be currently made use of as the an income source.

FHA funds

The new Federal Homes Government guarantees FHA loans, having shorter strict qualifications standards than simply conventional financing. The elderly are able to use the Public Coverage income so you can meet the requirements, nonetheless they may need to generate a larger downpayment, constantly around step 3.5% if the the credit history was over 580. Such funds require also home loan insurance premiums.

]]>