Amanda are a sales journalist and passionate about private fund. She loves to translate advanced information towards easy-to-discover blogs. Amanda co-built good SaaS business features caused smaller businesses and Fortune 500 names.

Do you loans your residence which have a federal Casing Management (FHA) financing? FHA loans try appealing to individuals which have shorter-than-finest credit scores otherwise smaller amounts conserved to possess down costs, unlocking the door to homeownership for some aspiring very first-date homebuyers.

In case the finances provides improved along with your credit history went up because you grabbed out your FHA loan, it may be time to refinance your FHA mortgage to a traditional financing.

We can make it easier to browse brand new refinancing techniques and story new conditions you’ll need to satisfy to help make the switch.

Refinancing Out of FHA in order to a traditional Home loan

This new “F” from inside the FHA mortgage does not have any to stand to own “forever.” For those who ordered your residence with the help of a keen FHA financing and want to explore a conventional financial, you will probably find the advantages are worth the brand new switch.

Refinancing out-of an enthusiastic FHA loan so you’re able to a traditional financial when mortgage costs was reasonable will bring you a diminished rate of interest and get rid of the financial top (MIP).

not, switching from an FHA mortgage to a normal home loan isn’t as simple as attempting to get it done. Are entitled to a re-finance, you will have to meet a few conditions, including:

- Credit history: You would like at least credit score with a minimum of 620 so you can be eligible for a conventional loan. (1)

- Debt-to-earnings (DTI) ratio: DTI ’s the quantity of your revenue serious about settling the monthly bills. The DTI proportion requirement vary out-of financial to help you financial, however you typically need a good DTI ratio off below 45% so you personal bad credit loans Minnesota can be considered. (2)

- Income: The bank have to make sure you earn enough income to cover the fresh new financing while the price of refinancing their original home loan.

- House appraisal: An assessment can assist determine how far collateral you’ve got when you look at the your residence. If you have at the very least 20% collateral of your home, you can prevent purchasing private financial insurance rates (PMI) once you re-finance.

When Any time you Re-finance Away from an enthusiastic FHA to a normal Mortgage?

Before you re-finance out-of an enthusiastic FHA mortgage to a normal loan, you will want to pick if it will be worth the efforts.

If any of the after the requirements apply to your role, it could be indicative that it is a great time in order to alter your FHA loan with a traditional mortgage.

We need to dump home loan insurance costs (MIPs)

The length of time you have to pay MIP on your own FHA mortgage will depend to the size of the advance payment you made. In case your downpayment was less than ten%, you are stuck that have MIP unless you fully repay the home loan. For folks who set-out ten% or more, you are carried out with MIP immediately after 11 several years of repayments.

To help you eradicate MIP you are going to need to re-finance their FHA financing so you can a conventional financing. If you I toward conventional financing when you have quicker than just 20% collateral of your property.

MIP and you may PMI is actually both particular mortgage insurance rates, however, MIP pertains to FHA funds, and PMI applies to old-fashioned mortgage loans. Once again, to prevent PMI in your old-fashioned loan, you’ll need to features at the least 20% collateral of your house.

Your credit rating is actually higher

If you had a credit score from 590 when you initially bought your property and it’s currently sitting in the 630, you will probably see an effective lender’s credit history dependence on an excellent antique financial re-finance. Very lenders want a credit history with a minimum of 620 to help you qualify for a normal financing.

]]>What is the Earliest Domestic Be certain that Program?

The first Home Be certain that Design was designed to help eligible first home buyers individual its earliest possessions fundamentally. It does it by making it easy for a buyer in order to get a property with a deposit only 5% without having to pay for Lenders Home loan Insurance rates.

The latest Design is delivered because of the authorities into the 2019 and it is applied from the Federal Houses Finance and you can Resource Company (NHFIC). It actually was in the past called the Earliest Home loan Put Scheme however, was rebranded throughout the 2022 together with level of metropolises offered having design people in for every single economic seasons has also been increased from the the period out of ten,000 to help you thirty five,000.

The latest scheme was also prolonged within the 2022 to include support specifically getting single mothers. There are now in addition to ten,000 House Pledges available for qualified solitary moms and dads with at minimum that created child who have in initial deposit from only a small amount due to the fact 2%.

2023 Changes on System

Throughout the 2023 Budget, the government revealed that the initial Home Guarantee Plan usually build its definition of a couple of so that friends otherwise two loved ones life style to one another to view in order to strategy. Since the 1st , one a few eligible someone can use for the Very first Home Verify Scheme. The expression single parent was also feel stretched out of you to date to incorporate courtroom guardians, plus aunts, uncles and you will grand-parents.

These the fresh new regulations plus affect past home buyers that have maybe not had a house in the past several years while the program might have been offered to provide long lasting people, together with Australian people.

Why Idalia loans does brand new System Performs?

The first Home Verify Plan permits qualified first home buyers in order to buy a property inside a certain budget having a deposit from as little as 5% (or 2% to have unmarried mother or father people). The NHFIC claims doing fifteen% of your property value the home that is financed from the good performing lender for solitary otherwise couple applicant or over to help you 18% of worth having single mother applicants. Usually, in place of in initial deposit off 20% of the house value, home buyers must take out mortgage insurance policies that’s a serious extra debts.

Eligible consumers also can utilize the First House Verify Program during the disadvantages, including the Earliest House Very Saver Program each county and you can territories very first homeowner grants and you may stamp obligations concession strategies.

Qualification Criteria

Enough requirements need to be found for taking advantageous asset of the first Domestic Make certain Design. Mostly candidates must be no less than 18 yrs old and you will feel an Australian resident otherwise long lasting resident. Should this be the actual situation, then following the then qualifications criteria incorporate:

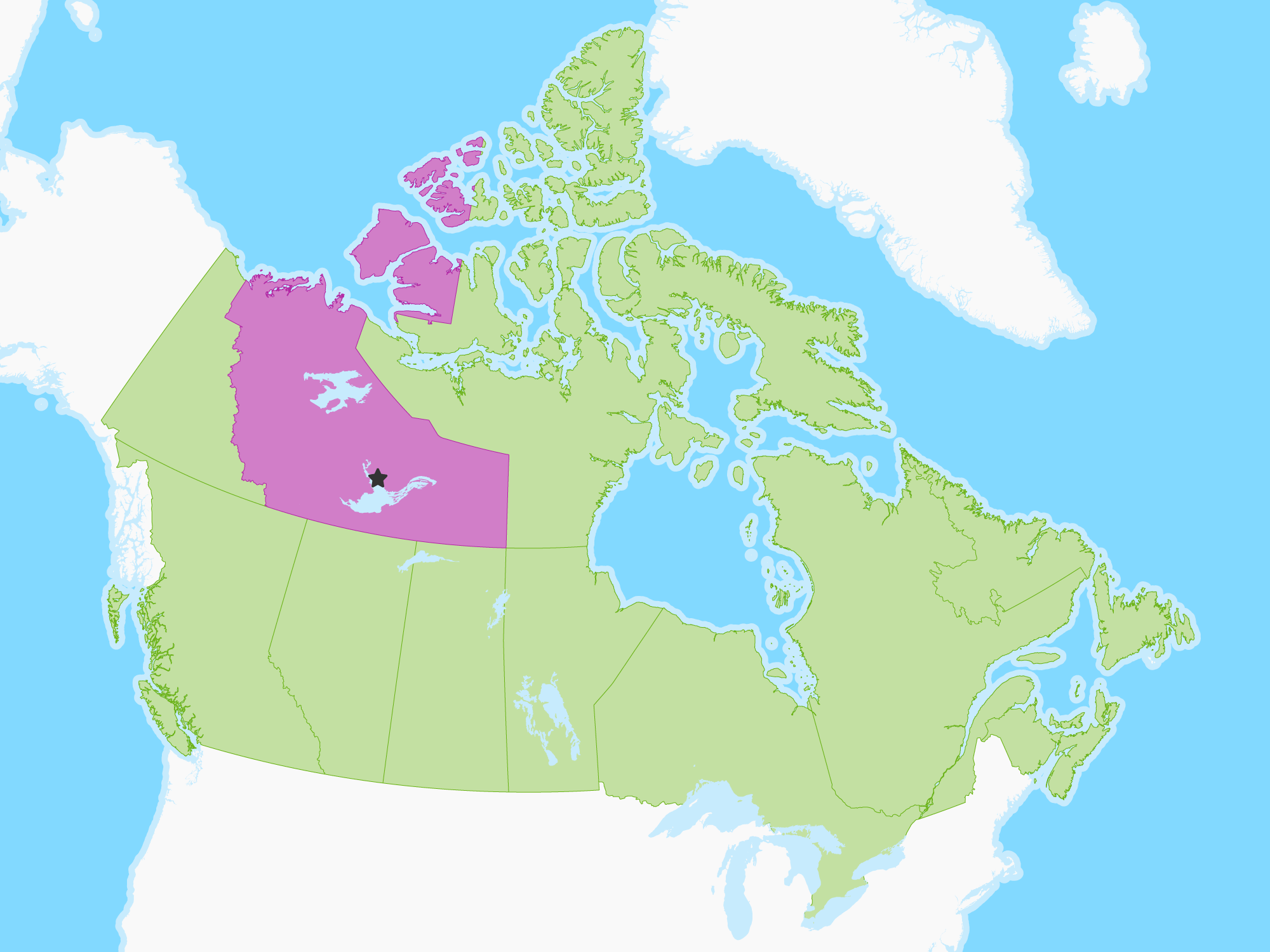

1. Rates Limits The worth of the newest home shouldn’t go beyond the cost limits that happen to be place because of the bodies to have each condition and territory. For the This new South Wales this new cover is determined within $900,000. The new limit signifies the full worth of the house or property and you may house consumers that are to get property-and-belongings bundle need to be specifically aware of this, while they risk with their software denied in the event the shared speed of the property and you will land is over the maximum limitation.

dos. Assets Items There can be freedom in terms of the type of possessions capable of being bought under the system yet not it’s important the home is a domestic one. Eligible residential properties are: a current house, townhouse otherwise flat property and you can residential property bundle home and you will an alternative price to create a home a from-the-bundle flat or townhouse

step three. Relationship Status Both single men and women and you may couples may benefit in the strategy. In earlier times, just couples had been entitled to the original Domestic Ensure whenever they was hitched or even in a good de–facto relationship. However, out of , others purchasing to one another, along with siblings or loved ones, was qualified. cuatro. Mortgage Criteria Fund beneath the First Domestic Guarantee want scheduled money of one’s dominating and you may attention of financing on the complete period of the agreement. Discover restricted exclusions to own attention-only money, hence mainly relate genuinely to design financing.

5. Money Thresholds A single person is approved when they earn $125,000 annually or shorter, since the are two whom produces a max shared earnings away from $2 hundred,000. Income must be given that shown to the applicants the new Observe from Evaluation awarded by Australian Tax Office.

six. Put Dimensions Becoming eligible for the system, minimal put dimensions are 5% of your total cost of the home. An individual moms and dad with people can have in initial deposit from 2%. The maximum put dimensions acceptance is 20%.

Playing loan providers

NHFIC features authorised a panel off 32 acting loan providers giving brand new scheme. The big lender lenders will be Commonwealth Lender and NAB, although some of one’s low-biggest lenders include Auswide Lender, Australian Army Bank, Bank Australia, Police Lender, Local Australian continent Bank and Indigenous Organization Australian continent.

If you’d like to know more about the initial Household Be sure Scheme otherwise any Property Laws topic otherwise you want suggestions otherwise assistance which have a house exchange, excite get in touch with our qualified property legislation experts, John Bateman or Michael Battersby to the 02 4731 5899 or email address united states within

- Purchasing your Domestic, Equipment, or Land

- Check the full collection to learn more