Save your self articles having later

Professionals on medical, court and you will studies areas is certainly one of a growing directory of masters that will rescue several thousand dollars when trying to get a home loan that have in initial deposit away from lower than 20 percent.

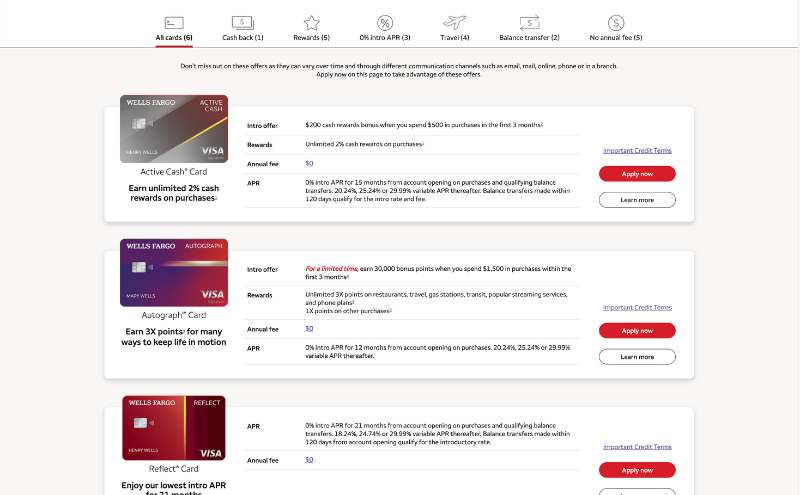

Various various other loan providers offer waivers to specific professions toward lenders‘ mortgage insurance policies (LMI), that’s constantly imposed for the individuals which have a deposit below one 20 % mark. LMI can cost several several thousand dollars and that’s usually additional on the payments during the loan.

Banking institutions provide such waivers to those within the services that are likely to be secure and you may pay good revenue. The top listing is actually health care professionals, even if anyone employed in studies, law enforcement additionally the court and you can accounting professions are eligible to have waivers of certain lenders.

Often, the brand new waivers was claimed by lender, but often you have to inquire. Sally Tindall, research manager within RateCity, claims though some banking institutions positively bring such elite waivers, anybody else try reported from the backwaters out-of bank websites.

Its good bunny out from the hat‘ key brokers and you can financial financing professionals is also take-out to possess clients given that lure out-of a private bring will help seal a great deal, she states.

Even though the cost of LMI is bought by debtor, it protects the lending company in case your debtor non-payments on the mortgage therefore the arises from the latest profit of the house would not coverage the cash due toward lender.

Whoever has a deposit away from lower than 20 % are thought become on higher risk than those who have alot more equity inside their services.

The expense of brand new LMI hinges on the value of the latest assets as well as how much the consumer try according to the 20 each penny tolerance, whether it is are bought from the a first-big date client and you will if the customer was a proprietor-occupier otherwise investor. Into a frequent domestic buy within the Questionnaire or Melbourne, it can prices thousands of bucks.

The fresh new calculator available with LMI merchant Genworth suggests LMI costs $twenty two,000 having a first-domestic consumer on the a purchase of $1 million, with a deposit out of ten percent toward a thirty-year home loan; higher still getting non-first-homebuyers.

Westpac recently stretched the LMI waiver in order to registered nurses and you may midwives. The change function qualified inserted nurses and midwives that have at the very least a beneficial ten % put can be steer clear of the a lot more initial costs off LMI once they earn over $90,000 a-year.

Nurses and you can midwives give a great provider to your communities, therefore we was pleased to help them get a property ultimately of the waiving several thousand dollars into the LMI, states Chris de- Bruin, individual and business financial leader on Westpac.

These types of specialities as well as generally interest a more impressive proportion of females, and now we is actually passionate about providing so much more female buy her house. and build financial liberty, de Bruin claims.

By the John Collett

Incorporating nurses and you will midwives lengthens Westpac’s currently extensive record away from qualified medical researchers, in addition to dentists, GPs, optometrists and you may pharmacists, and others, given they satisfy lowest money standards.

Several loan providers, such as for example St George, Lender of Melbourne and BankSA (all of the belonging to Westpac) and you can BankVic, provide LMI waivers so you’re able to earliest-homebuyers.

Tindall says if you find yourself financial institutions waive the newest LMI rates to have lowest-exposure disciplines, they may nonetheless slug this type of borrowers that have high interest rates in order to have a good wafer-narrow deposit.

While this may seem for example a little rate to blow so you can duck LMI, a top interest is able to cause extreme monetary problems over the longer term, she says.

There are also reduced put strategies, supported by the us government, being distributed courtesy lenders. These types of allow it to be being qualified first-home buyers to invest in a house having as little as a 5 percent put without fast payday loan New Union Alabama having to pay the expense of LMI.

Tindall claims basic home buyers which have quick dumps will be think on using a particular lender simply because he is giving a no cost LMI bargain, even if you to definitely package try supported by among the many government government’s low deposit strategies.

The individuals to shop for having a small put if you’re possessions costs are shedding can find they end up getting little or no guarantee when you look at the their loan contained in this days, she says.

Among the federal government-backed strategies, called the Home Make sure (FHG), lets eligible single parents that have one or more built youngster can also be pick property having a deposit off simply dos %, and never purchase LMI.

]]>