step 3. The straightforward focus loan calculator out of Spreadsheet123 try an elementary and you will brush finance calculator filled with financing sumortization plan.

cuatro. If you have that loan which allows to have a destination-simply several months, Spreadsheet123 have a free attract only online calculator having amortization schedule. Your input the fresh regards to the loan because you would any kind of template right after which setup exactly how many years your own loan might be desire-simply. New schedule will likely then to evolve correctly.

Home loan Amortization Plan Templates

However some standard financing amortization layouts is useful for home financing, you can find nuances with your financing that are top addressed by a professional template. Home loan amortization templates could possibly deal with may be while the material episodes to possess rates of interest and you will balloon fee funds.

5. The brand new free Do just fine home loan amortization schedule theme from Smartsheet varies from its general plan in lots of ways. It allows that enter into a material several months, such as for example semi-annually. New template will guide you how getting additional money into your own schedule have a tendency to feeling your debts as well as your final benefits date.

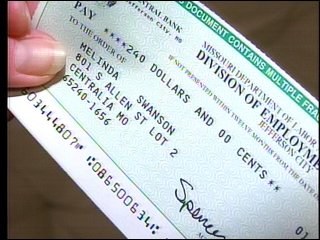

$255 payday loans online same day Delaware

6. Sortization agenda layout takes on that you will have a single large fee at the end of your loan. Your input all of your current mortgage words since you do any other mortgage additionally the number of this new balloon fee, hence theme gives you a proper agenda.

seven. Microsoft Place of work now offers a totally free Mortgage loan Calculator to own Excel you to has an amortization desk. You simply go into the cost of the house, the loan matter, Annual percentage rate, mortgage size, and begin day.

8. offers a totally free Do just fine financial calculator which have amortization schedule layout. Brand new theme usually respond automatically after you make transform to the latest enters, such as the loan amount, interest rate, mortgage label, payments a year, recommended more commission, and you will mortgage start go out.

nine. When you yourself have a changeable-rates home loan (ARM), the fresh new free Case calculator that have amortization schedule out of Vertex42 ’s the top theme alternatives. It permits one to enter your loan conditions, for instance the rate of interest cover, exactly how many days to another location variations, therefore the requested variations regarding rate.

A home collateral loan fundamentally acts as an alternative financial, but you wouldn’t qualify for one of them loans if you don’t have enough guarantee of your property. A loan amortization agenda having household equity makes it possible to determine the amount of equity your carry in your residence immediately following you have paid back into home financing getting a certain several months.

ten. Sortization agenda layout for Prosper. You enter your current mortgage loan terms and conditions, and it also will provide you with each other a timetable and you will totals to your principal and you may attention paid off towards mortgage. You’ll be able to determine what will happen by creating additional repayments and exactly how enough time it would take you to pay off each other a home loan and you can home guarantee mortgage.

11. If you are searching to trace new repayment out-of property equity credit line (HELOC), Vertex42 has a free HELOC calculator having amortization schedule. You only installed your borrowing limit or any other terms and you will you can find multiple repayment selection and additionally a timetable one to demonstrates how much youre investing throughout the years.

Auto loan Amortization Plan Themes

When it’s time and energy to get a different sort of gang of rims, its useful to know exactly exactly how much you can afford in order to spend when you take away a loan. Suitable mortgage amortization agenda will give you the full visualize including financing attention and you will you’ll be able to charge.

several. Sortization plan theme which is very in depth. You could potentially enter facts about the price of one’s vehicle, costs (title, membership, taxes, etcetera.), your trading-for the worthy of, and your financing words. You will get returns letting you know new payment, complete money, total focus repaid, and you will a payoff day with a plan.

]]>Financing process tips need to be done at the very least 2 weeks earlier in order to disbursement to ensure that you receive their fund within the a great prompt trends, apart from the brand new Brief Improve.

Government Direct Money

Talking about accessible to student and you will scholar pupils which subscribe during the the very least 1 / 2 of-day. Pupils commonly accountable for notice accrued to your Paid Head Finance while in school. Unsubsidized Government Direct Fund are supplied so you can pupils who do maybe not be eligible for the newest Paid Direct Loan otherwise carry out meet the requirements and so are nevertheless wanting additional investment. College students have the effect of appeal accumulated to the Unsubsidized Lead Money if you’re in school. Annual Head Loan borrowing limitations having established student people try $5,500 getting freshmen, $6,five hundred to own sophomores, and you will $7,500 to possess undergraduate children past Sophomore condition. Separate student pupils get acquire a lot more unsubsidized finance outside of the a lot more than mentioned constraints (most number depends on instructional position). Scholar students can get borrow doing $20,five-hundred annually within the Unsubsidized Direct Finance. Fees of principal and you can accrued attention begins six months after the student students, withdraws, otherwise falls less than half-time enrollment. There is no punishment to possess accepting a partial amount borrowed.

- Government Loan Charges & Interest levels

- Access Guidance

- People who have Maybe not gotten a national Head Financing owing to FAU while the 2002 need to over Access Counseling just before disbursement

- Get off Guidance

- People who possess gotten Government Direct Money need complete Leave Guidance in advance of making brand new University

- Information regarding earnings-driven payment of Federal Fund

- Grasp Promissory Note

- (To access school funding records)

Seniors within Last Session

Whenever an enthusiastic undergraduate borrower’s remaining period of analysis is actually shorter than an entire informative 12 months, the latest Direct Financing should be prorated centered on registration. Failure to notify the fresh Beginner School funding Place of work before the beginning of a final session may result in instantaneous repayment away from a portion of your own Lead Loan. College students whom owe a balance to help you FAU does not receive the diplomas.

Complete and Permanent Impairment Release

An internet site . has been adopted on Complete and you will Long lasting Handicap (TPD) Launch techniques. Individuals looking to an impairment release of the FFEL Program loans, Head Mortgage System money, and you will Teacher Knowledge Direction for College and higher Education (TEACH) Offer service personal debt discover complete guidance from the this new TPD Discharge Webpages.

Federal Together with Fund

The newest Government Lead Also Loan is a low interest rate loan readily available to assist mom and dad out-of depending youngsters accepted and you may subscribed to an student training program or graduate people admitted and enrolled in a graduate studies program. Is entitled to the Head And Loan, the newest mother or father borrower or the scholar college student debtor must have no adverse credit history. Limitation qualification is equivalent to price of training minus most other help. Cost away from prominent and attention starts within 60 days after the financing try fully disbursed. The individuals is generally eligible to delayed payment until student graduates otherwise ceases becoming enlisted no less than half of-big date. To help you discover an immediate Plus Financing, youngsters need earliest document a free Software to have Federal College student Services (FAFSA).

Private Funds

Private figuratively speaking (labeled as choice funds) are low-federal financing, made by a loan provider particularly a lender, borrowing commitment or condition institution. Federal college loans were many benefits (eg repaired pricing, income-depending installment plans, and you may financing forgiveness plans) maybe not usually supplied by personal loans. In some instances, personal funds is costly than just Federal college loans. A student should never think borrowing from the bank out-of an exclusive mortgage program up to he has worn out each of their Government Mortgage solutions very first.

]]>Due to the fact lovers browse the latest advanced means of separation, it face challenging conclusion around the brand new spirits of your own relationship household and potential financial financing choices. And make better-advised possibilities is very important to possess assisting a seamless changeover through the and you will following the breakup. Residents must meticulously identify home loan options with the family home and you will incorporate these types of to your relationship payment arrangement.

The latest devotion of post-divorce domicile try required, with lots of deciding to remain in your family residence. Yet not, maintaining possession of one’s relationship domestic is going to be a beneficial convoluted procedure, requiring the preserving lover to take care of certain methods to make certain a beneficial favorable result.

A prevalent issue requires the removal of the vacating partner’s name about term of your icable splitting up, the presence of this new vacating wife or husband’s term with the title could possibly get precipitate coming difficulty. By way of example, if the sustaining mate decide to offer the property, new vacating companion might place state they a portion of the continues.

So you can prevent such points, it is advisable to expeditiously get rid of the vacating spouse’s label out of brand new identity. Although the couple can get already maintain cordial affairs, situations can also be move, helping to make the new procurement of the vacating wife or husband’s signature to your expected files much more rigorous.

Yet not, not all financing is assumable, therefore the retaining spouse’s qualification to own loan assumption is contingent through to its creditworthiness

Yet another thought pertains to the process of getting from vacating lover or extricating them about financing. Financing presumption requires and in case obligation on existing home loan, while refinancing necessitates protecting another mortgage about retaining spouse’s title.

Several streams exist to take action, such mortgage presumption otherwise mortgage refinancing

Refinancing may be the maximum choice for specific divorcing couples, since it allows brand new sustaining lover so you can procure a separate mortgage solely inside their term. Which provides a feeling of monetary flexibility and you may allows this new preserving companion to visualize full possession of your own marital family.

The fresh new feeling regarding rising rates of interest on the divorcing property owners is also distinguished. The entire financial interest early in 2022 stood at the step 3.50%, However, mortgage cost enjoys steadily improved for the past seasons, with prices today surpassing six.75%. Getting divorcing people just who hold the marital house, the prospect regarding refinancing the present mortgage during the current cost normally getting challenging. For example, the main and attract money for a beneficial $five-hundred,000 30-year financial on step 3.5% amounted to help you a payment per month out-of $2,. A comparable mortgage during the 6.75% would result in a payment per month out-of $step 3,.

In the sumine mortgage resource choices and you may need such within their relationship settlement contract. Getting rid of the newest vacating spouse’s label about title and installing an effective way of get them away otherwise get them on financing are very important steps in the fresh divorce case. Of the working together having a skilled home loan elite, divorcing home owners tends to make advised idst rising interest levels.

- Q: Exactly what are http://availableloan.net/installment-loans-ks the primary mortgage resource choices for divorcing homeowners exactly who want to preserve its relationship house? A: The key mortgage financial support choices tend to be financing assumption and refinancing mortgage. For each option has its own advantages and you will restrictions, hence should be cautiously believed in line with the private circumstances out of new divorcing people.

- Q: Why does loan presumption range from refinancing mortgage? A: Mortgage assumption involves the preserving spouse and if obligation on existing home loan, while mortgage refinancing requires the retaining companion so you can secure a new financial in their label.

- Q: Do you know the possible benefits associated with mortgage expectation when you look at the a separation and divorce? A: Financing expectation is a fees-productive solution in case the established mortgage’s interest is leaner than just latest costs. It can also describe the newest divorce payment processes by avoiding the newest need to re-finance otherwise offer the property.

Okay, so we you prefer a whole lot more money of these programs that are not higher focus

The issue is it’s impossible on $200K+ HHI that OP owes nothing and also in thirteen years it often amazingly get forgiveness. At their money there must be a good monthly payment. And additionally, this type of arrangements change-over time, therefore much can take place during the thirteen decades, meanwhile the eye continues to grow quickly since the OP will pay absolutely nothing (otherwise next to nothing). It is therefore really not extremely smart to not be concerned about using all of them off. To allow them to „have fun with the system“ however, any nothing hiccup and additionally they might end upwards owning $400K+ and can not be able to perform you to definitely. While at the money, they are able to gear off and pay the latest funds they actually grabbed.

As well as, I would personally prefer to understand the plan where it pay also $500/times therefore only vanishes from inside the thirteen age for the far inside the financing. We believe a troll.

It sounds as if you would rather inhabit a scene where all of everything explain is the case, however, the good news is your requirements are not means reality. Thought discovering on the money-driven repayment arrangements just before speculating subsequent.

Also, one out from the four IDR preparations is statutory, so great luck with anything changing punctual thereon one to.

But when you alive as if you make $50K for five+ many years you are able to an enormous reduction in those loans

Better its absurd! What happened to help you individual duty? Do not capture figuratively speaking you are unable to afford to expend right back, it is easy

Once the of numerous specialities Require certain degrees. Heck, is good PT at this point you you want a doctorate. As to why should not somebody take them out for a longevity of functions it love as they are good at? Or should do?

Colleges and you may Unis you will definitely straight down tuition. There is low or no notice funds. Several things one to you should never wanted visitors to give up its field preference.

We have not issue with it and do not understand the you prefer so you’re able to work out within lifetime to repay specific financial that’s gouging consumers, and you will chair it as „personal obligations.“

But even then, getting a beneficial PT is costly and you also more than likely wouldn’t make even six numbers to own a long time, otherwise much more than one to except if for the a great HCOL area (I know, one to child began wanting to become a beneficial PT). But when you want to grab $200K in figuratively speaking you will need having plans to pay it off. The answer isnt—I do want to be XYZ very I’ll simply take the new fund and you may pledge it truly does work out. You ought to arrange for 10+ years of purchasing $1K+/times to blow it off. You shouldn’t merely get to shell out nothing and possess out of your loan. So you should feel a good PT, then you understand you could have 5-ten years in the office hard to pay off enough of this new financing up until he is forgiven.

However, some one need along the build that they’ll just take loans and all of was forgiven. I understand—my wife and i finished that have

$75K for the finance (30+ years back) much of it at typical rates—consumer loan not fed financing, NH title and loan we buckled off, resided using one earnings and place the 2nd money with the student loans. dos.5 years later it actually was paid off. Next i proceeded to live frugally (thought somewhat better than as the graduate children however far) and you will protected to own an advance payment. We didn’t increase all of our way of life height much out-of scholar college or university having more than cuatro decades as we finished—all of the therefore we you will definitely pay the individuals pesky finance and also to your a financial stronghold.

]]>