On this page

- USDA Home loan

- What Credit rating needs to own an effective USDA Financial?

- How are Credit ratings Depending?

- Extenuating Circumstances

- Benefits associated with Having a healthier Credit score

- Waiting Periods to own Foreclosures or Case of bankruptcy

USDA Financial

USDA mortgage brokers are perfect alternatives for rural basic-date homebuyers. Within our earlier in the day one or two blogs, i shielded the primary benefits associated with a USDA home loan, therefore the income restrictions borrowers should discover. There are certain criteria associated with which financing system supported by the united states Service regarding Farming.

We advice your have a look at first two posts contained in this show to learn more:Part step 1: What is a USDA Mortgage?Part dos: Income Restrictions

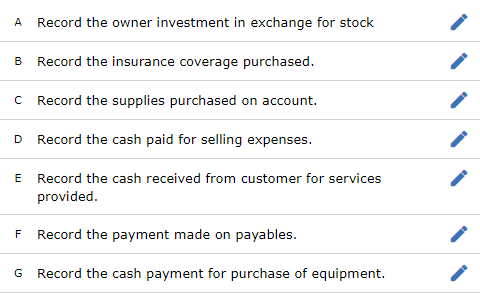

Just what Credit score becomes necessary having a USDA Mortgage?

Many very first-day customers was a tiny concerned with its credit history and you will how it commonly perception their capability so you can be eligible for a home loan loan. Every loan providers can look within borrower’s credit rating, along with other secret monetary evidence. They might be, but they are not limited to help you, income, debt-to-earnings (DTI) proportion, a job record, offers and other bills.

Minimal credit score lay by the most USDA-licensed lenders was 640. When you yourself have a great 640 FICO rating or even more, you are out over an increase when making an application for a good USDA mortgage. Again, this isn’t the only thing the lender and you may USDA tend to check whenever underwriting and you will granting the loan. It’s possible to have outstanding credit history, but get in crappy contour in other section. Otherwise, you might be during the great figure using the rest of your finances, but i have a decreased credit rating for some reason.

Just how try Fico scores Mainly based?

Essentially, credit ratings is actually created as a result of payment out of recurring expense or any other costs eg rent, insurance coverage, resources, college or university tuition otherwise child care. There are instances when someone have a decreased credit history as they just have not situated much borrowing. Racking up a lot of personal credit card debt have a tendency to hurt your own DTI, nonetheless it can actually getting good for your credit score if the you are making your own minimum monthly premiums. Meanwhile, people with no credit cards, auto loans, rent, school tuition otherwise extreme credit records may actually keeps good weaker FICO get.

That’s why lenders and you will loan underwriters look during the every factors to determine if house visitors qualifies to possess a beneficial mortgage. Of these having a smaller-mainly based credit history, the lending company may also be in a position to agree the new USDA domestic financing in the place of a low-traditional credit file. There is certainly other third-team verifications which are utilized to confirm you are a deserving credit candidate.

Extenuating Items

Which have USDA money, however, at least rating from 640 was a fairly strong benchmark. They do possess recommendations positioned that will allow for individuals with down score in order to be considered. Consumers may be qualified if they have educated a certain extenuating circumstances. These include:

- Work layoff because of staff members prevention

- Scientific crisis

- Most other incidents not in the applicant’s control.

New extenuating situation should be a one-big date experiences plus it shouldn’t be a meeting that is almost certainly to happen once again. In addition it can not be a direct result the newest applicant’s inability to do his or her finances.

Extenuating issues not in the applicant’s manage is the place there’s specific gray urban area because it’s a little harder to explain. When you find yourself unsure of one’s situation and even if it might allow you to qualify for good USDA loan, it is advisable to keep in touch with USDA-formal lender.

Benefits of That have a healthy and balanced Credit rating

The higher your credit score, the higher away from you may be whenever trying to get people mortgage-particularly a USDA mortgage. Borrowers having fico scores out of 680 or higher may benefit off a sleek acceptance techniques and have a better likelihood of qualifying. Finest score and you can certification conditions and additionally constantly convert to reduce focus rates to your mortgage, also.

Wishing Attacks having Foreclosure otherwise Case of bankruptcy

USDA loans are mainly intended for very first-go out home buyers. If you’ve had property before, you may still be able to meet the requirements. You merely never already own otherwise consume a property that money can not be used in 2nd house otherwise money spent commands. When you have undergone a bankruptcy proceeding otherwise foreclosure, you might be at the mercy of a waiting period before you could are entitled to a good USDA loan:

To see if youre entitled to an effective USDA financing and you can to get started along with your software process, contact Moreira Team now!

]]>- All of the loan providers

- Banking institutions

- Non – Finance companies

- Professional loan providers

- Borrowing Commitment

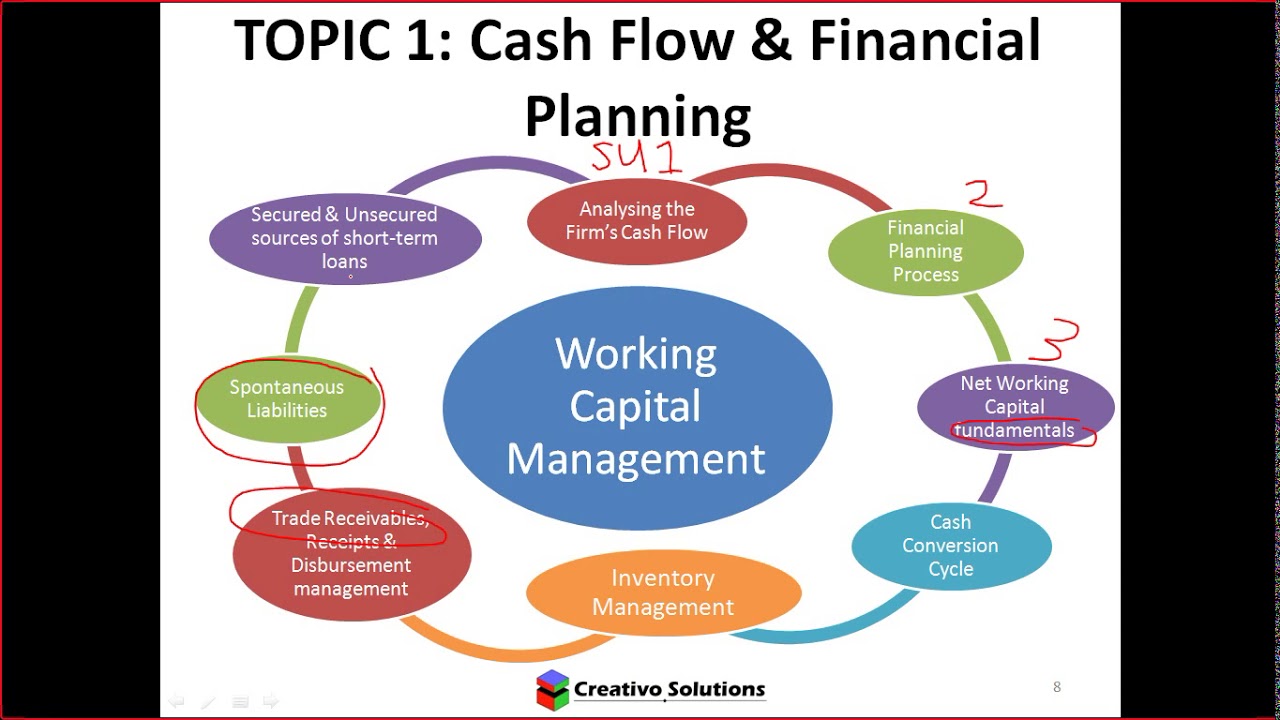

Just how performed i opinion financial institutions?

I depending the remark toward significantly more than speed. We planned to work with whenever they deliver a beneficial results for their people.

Competitive rates of interest

We all love low interest rates! We did not simply go through the rates now. As an alternative, i checked-out their historical pricing of course they tend in order to compete or if they slowdown behind another banking institutions.

Think about pro lenders? These firms use a rate for exposure model in which some other people is actually charged different cost and you may costs. We looked at when they charging fair pricing for just what they give you.

Flexible borrowing guidelines

Carry out it accept home loans forever some one and you can decline funds for the right causes? Would they see you as an individual being or good matter?

Many of the major loan providers have fun with a computer algorithm entitled credit scoring now. In these cases, i checked out in the event the their credit rating try real, if this discriminated up against particular debtor items of course, if it may getting overridden in which it actually was clearly wrong.

Price and precision

While refinancing, then you most likely dont brain if your mortgage is delayed a few weeks. However, if you might be to get, an equivalent delays may cause a psychological breakdown. Regarding the poor times, some body overlook its dream domestic since their lender was too sluggish.

Banking institutions has special deals as well as have inundated of the apps most of the time so be aware that right now they can be slower otherwise less than we now have analyzed. Exactly what we’re considering is when they tend to obtain some thing correct otherwise commonly help all of our consumers off.

Reputable or unsafe

The best Washington personal loans GFC is actually the perfect exemplory case of a period when the fresh new financial institutions been able to gouge their clients. Which ones took advantage of their customers and you can which failed to?

Some loan providers along with had slammed of the mass media and you will consumers whenever indeed they’d answered in order to a genuine escalation in their prices away from funds. The general public cannot constantly share with the real difference, but we could!

This takes into account when they certainly around to assist people or if perhaps these are typically truly around to help their investors! Customer had financial gets an enormous tick in this field.

Who is this new customer?

Otto Dargan is the Creator regarding home loan broking corporation Mortgage Experts. They are obtained Australia’s Smartest Agent double! That’s zero mean accomplishment given there’s doing 11,000 lenders around australia.

Otto integrates comprehensive mortgage broking feel, great contacts within the world, assets capital and you may a passion for enabling people to find good ideal home loan.

Banks: This is basically the most typical brand of bank, giving numerous mortgage things. He’s better-established and now have a good reputation. Examples is CBA, Westpac and you can Macquarie.

Retail Loan providers (through General Non-Banks): These firms provider funds from general low-finance companies and gives financing not as much as their brand. He or she is controlled by Federal Credit Safeguards Operate and you will are required to getting registered otherwise inserted having ASIC.

Expert Low-Banks: These firms specialize during the giving financing to people that do perhaps not fit the typical financing standards, like those which have poor credit otherwise uncommon possessions characteristics.

Credit Unions and you will Strengthening Communities: These firms was belonging to the participants and provide competitive interest rates and costs. They could be regional and you can suffice specific geographic components otherwise communities of individuals.

That’s Better: Credit Unions, Finance companies or Non-finance companies?

Whenever determining which type of bank is the best for you, thought factors such as your monetary wants, credit rating, and also the features you prefer. Borrowing from the bank unions are recognized for its member-centric strategy, straight down charge, and a lot more aggressive rates of interest. Finance companies, concurrently, is actually having-profit associations one to prioritise stockholder hobbies and could offer a greater directory of attributes. Non-banks also have specialized lending products however, often feature large can cost you.

Exactly what Can i Thought When deciding on a lender?

Guarantee the bank has a specialist site with associated guidance, like an enthusiastic Australian Team Count (ABN) and Australian Credit Permit (ACL) amount.

Ensure the financial was authorized by the Australian Bonds and you may Financial investments Fee (ASIC) that’s a person in the newest Australian Monetary Grievances Expert (AFCA).

Consider lenders one to specialize on the sort of mortgage you prefer, eg low-put home loans, poor credit mortgage brokers or financing for worry about-employed borrowers.

Choose a lender which have useful and you may receptive customer service who’s prepared to work with you to obtain the right mortgage.

]]>