Sharga: “Buyers who can handle this new economic obligation of homeownership, and you may who will pay for monthly payments in the the present home prices and you may financial prices, are likely better off to purchase than simply prepared. Limited also provide will likely continue steadily to push home values highest, and it is unlikely that financial cost will plummet for the 2025 for people that waiting. Borrowers with equity may still envision experiencing those funds in order to reduce higher cost obligations billed from the playing cards, personal loans, automobile financing or figuratively speaking, and that normally have higher interest rates than simply rates on a finances-away refinance mortgage.”

DiBugnara: “Interest levels, at that latest go out, is always to just impression to get or perhaps not to get should your home you are looking at is out of your allowance. In the event that a buyer will get property that suits their needs and budget it’s a very good time to buy. One prepared months when planning on taking advantage of a lesser speed industry is only going to lead to paying a much higher price as the off increased competition.”

Orefice: “The fresh homes , nonetheless it continue to be market where wise users should loose time waiting for all the way down cost if they can maybe perform it. For folks who seriously want to get a home loan from inside the 2024, choose an initial-label Sleeve (adjustable-speed mortgage) you could re-finance when rates start to slip.”

Potential customers should carefully analyze its monetary status, check out the prospect of speed hair, and stay adjusted so you’re able to may sound sensible for many, for others the right moment might be if the personal monetary criteria line up with field possibilities.”

The bottom line

Develop, these types of 2024 mortgage rate predictions and you will advice allows you to build a informed decision with the whether to purchase and you may finance a house. However, just remember that , your own personal situation is unique, and suggestions over may well not fit with lifetime needs, timing, or cost.

For best results, it is usually wise to demand closely having a reliable a house representative or Agent, a talented financing elite that will recommend other mortgage alternatives one to see your financial means, a real home lawyer who can ensure that you is legitimately shielded during the a deal, and you will a personal funds professional or official financial elite who will make it easier to crisis the amounts and better know if to invest in now in the place of afterwards is the right move.

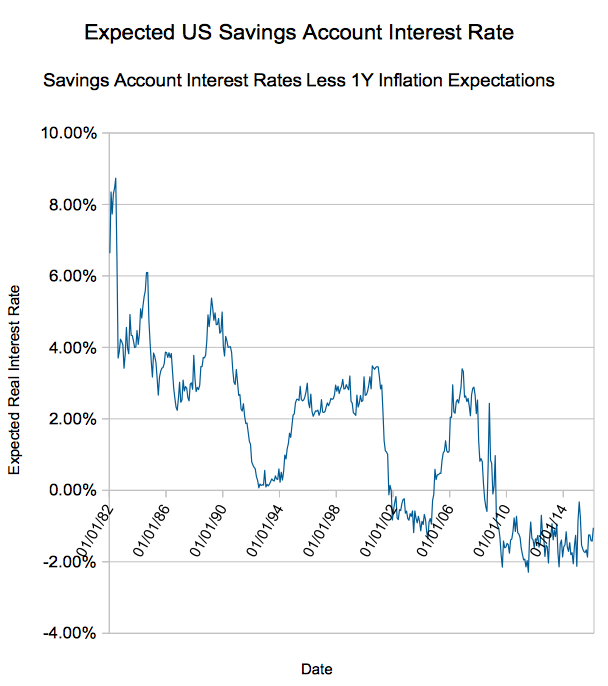

Richard Staniszewski, President, Hera Title: “What is actually most stunning to me in terms of the fresh new present state out-of home loan costs in the a national level is the fact of a lot professionals have gotten they wrong. Mortgage rates have been in lockstep with rising prices consequently they are currently popular a lot higher than just projected. Basic economics indicate that an increase in money also provide beyond typical gains rates shows a tendency for large rising prices. We discover ourselves now needing to react to the difficulty out-of new inflationary ecosystem into limited gadgets of one’s Provided. New Fed merely normally respond to studies, whenever you are our policymakers is contour the outcomes of one’s research.”

Naghibi: “I believe a performance a lot more than eight.0% an average of is likely, just like the the latest produce curve remains ugly. I do know you to definitely Bloomberg, the brand new Chi town Mercantile Change, and several economists greeting at the very least two-rate incisions through the 2024. not, banking institutions have been facing unprecedented internet notice margin constraints. He is while making less overall and can have to recover the earnings for the 2024, regardless if rate cuts exists. And, similarly to brand new 29-season rates, I do not enjoy a fall below 6.25% towards 15-12 months fixed rates home loan.”

We expect put pricing to decrease in accordance with Provided Funds speed incisions, however with an ugly produce curve I really don’t look for 10-year treasuries shedding lower

Gelios: “Knowing your financial allowance and you will the spot where the amounts is is paramount to to shop for property successfully. While it to shop for property, people who hold off could well be faced with even higher home prices and a lot more customer battle. Homebuyers should be cautious not to overspend or be impractical on which they’re able to or can’t afford. They should never be also concerned about the loan rates while the a refinance is obviously an alternative if the cost reduced amount of new coming many years. At exactly the www.paydayloanalabama.com/whitesboro same time, the individuals trying to re-finance inside 2024 need to look from the the length of time it takes them to recoup the closing costs.”

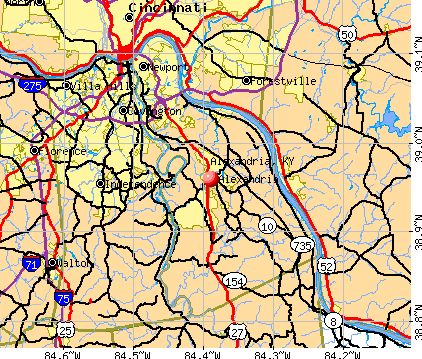

]]>USDA (brand new U. These money succeed reduced-to-reasonable money individuals to buy a property in the an outlying city of the nation. This may place you out-of if you don’t must live-in an outlying town or a tiny urban area; not, you should know one nearly 97% of the nation was USDA-qualified. That means that you don’t need to control animals and you can live on a farm.

With our loans, you can installment loans in Alaska purchase 100% financial support and there is zero advance payment needed. Always, to own a sleek mortgage, you need a score regarding 640 or more. But not, even when the get is not enough, bringing a little extra records makes it possible to get approved.

Va Fund

Brand new U.S. Company regarding Seasoned Affairs also offers higher financing for the majority armed forces people. Regardless of whether youre a veteran or still energetic, if not look into this option. If sometimes people is approved, this type of Va-recognized financing have lower rates of interest plus don’t need deposit. Both, a funding payment will become necessary however it are found in the loan will cost you.

A huge incentive here is there is zero financial insurance coverage or the absolute minimum credit rating. Also, when you’re struggling with the mortgage repayments, the latest Va might be able to renegotiate the brand new terms and conditions with the bank making it smoother on you.

In the event you or him or her have been injured via your service and just have an impairment, you could potentially get handicap property grants. It can help you see a home that’s adapted to own their disability or adjust a house making it available.

Local American Head Financing

The NADL or Local Western Head Financing was a loan program for Native American Pros. This choice allows Local People in america just who be considered to acquire, construct or raise assets into the accepted believe property. There are not any down payment otherwise mortgage will set you back, which is a huge together with.

A number of the standards for it loan is a credit score of over 640 in addition to constant earnings and this should be capable coverage the loan will set you back, will set you back out of managing a property, other expenses and supply for your needs.

Federal Homeowners Finance

NHF provides homeowners having a down-payment and you can/otherwise closure pricing advice (DPA). NHF DPA offers in order to 5% of the mortgage loan amount and you may comes in the form of a zero rate of interest 2nd mortgage (which is forgiven immediately following three years) otherwise something special (because FHA financing).

Without to expend back that it mortgage is very good in case you are making reference to other personal debt. You don’t have is a primary-go out consumer and also the FICO rating and earnings criteria was versatile.

Federal national mortgage association and you can Freddie Mac

Federal national mortgage association and you can Freddie Mac computer try bodies-backed businesses (GSEs) which get properties off loan providers towards the secondary home loan sector. In that way, they assist earliest-time customers reach their purpose of home ownership. Exactly how which really works is that individuals need certainly to set out because the nothing since the step 3% while the advance payment. This can be also a gift from household members otherwise relatives. Minimal get needed for this really is 620 and you can features to cover home loan insurance policies.

Other Of good use Mortgage Advice

In the event you pick up against these fund or if you do not meet the requirements, you can turn-to those traditional and less old-fashioned lenders i above mentioned. But not, when performing one, it is vital to understand that don’t need the initial offer you rating. Contact several loan providers to check out what kinds of pricing and you can conditions they supply.

Also, if your wanting to simply take this altogether, thought whether you’re really happy to deal with most of the will cost you out of ownership. Mortgage payments won’t be your own simply expenses since you never overlook their utility bills or any other can cost you out of life style.

]]>Financial Lenders‘ Pricing

While we defense a selection of products, organization and characteristics do not security all equipment, supplier or provider in the market. What and issues contained on this site dont compose suggestions or tips to buy or submit an application for one sort of tool. One pointers offered on this site try of a standard character simply and does not make up your needs, expectations and you can financial predicament. Items included on this site may well not suit your needs, objectives and you can financial predicament. Please think over be it appropriate for your needs, before making a decision to use otherwise buy any product. If you are considering getting any economic tool you should purchase and read the relevant Unit Revelation Declaration (PDS) and you will Target audience Dedication (TMD) and/or other give document before making a financial choice. , , , , and therefore are area of the InfoChoice Group. With regard to complete disclosure, the fresh new Infochoice Group is actually of the Firstmac Category. Excite understand Information about how exactly i benefit, products we examine, how we do conflicts of interest or other information from the our very own services.

Information

brings general pointers and comparison attributes to make informed monetary behavior. We really do not coverage all device otherwise merchant on the market. Our very own service is free of charge to you due to the fact i receive compensation away from unit company to possess backed positioning, advertisements, and advice. Significantly, this type of commercial matchmaking do not influence our very own editorial ethics.

For more more information, delight reference our very own How exactly we Get money, Handling Problems of great interest, and you may Editorial Guidelines pages.

Editorial Ethics

In the , we have been passionate about enabling Australians make told financial works tirelessly to give you specific, relevant, and you will unbiased suggestions. I pleasure our selves on keeping a tight s, making certain that the content your comprehend depends purely toward merit and not dependent on industrial interests.

Marketer Revelation

The services is free of charge to you, as a result of service from our couples owing to backed positioning, advertising, and you can ideas. I secure payment by the generating factors, referring you, otherwise once you click on a product or service hook up. You could also select advertising in emails, paid blogs, or close to the website.

Unit Publicity and you will Sort Acquisition

We strive to fund a standard product range, business, and characteristics; however, we really do not safety the entire business. Products in all of our investigations tables try sorted considering some affairs, and additionally unit keeps, rates of interest, payday loans Craig costs, dominance, and you will industrial plans.

Certain activities might possibly be marked since the promoted, looked or sponsored and may also appear prominently about tables irrespective of of their functions.

As well, particular facts can get introduce versions made to send one to related businesses (e.g. all of our mortgage broker mate) whom might be able to help you with activities on brand your picked. We might found a payment for which suggestion.

You might customise your search playing with our sorting and selection equipment to prioritise what matters most for your requirements, although we do not contrast all the has actually and several results associated which have industrial agreements can still arrive.

Testing Rate Alerting and you will Foot Criteria

Having home loans, the beds base standards become a beneficial $five hundred,000 amount borrowed more thirty years. For car loans, the base criteria are a good $29,000 loan over five years. Private funds, the bottom requirements tend to be good $20,000 financing more than 5 years. This type of pricing are only instances and may not tend to be most of the fees and you can fees.

*This new Research speed is dependent on a beneficial $150,000 mortgage more than 25 years. Warning: so it assessment price is valid just for this situation and may maybe not tend to be the costs and you can fees. Various other conditions, charge and other loan numbers can result when you look at the an alternate evaluation rate.

Monthly Repayment Figures

Month-to-month repayment data is actually prices that prohibit fees. Such quotes are based on brand new said prices on the given term and amount borrowed. Real payments is dependent on your circumstances and you can interest changes.

Monthly payments, due to the fact feet requirements are changed from the associate, will be based into picked products‘ stated prices and you may determined because of the amount borrowed, installment form of, loan name and you may LVR once the enter in because of the member/your.

]]>You are able to get a debt consolidation providers to help you. Yet not, they frequently charges hefty first and you will monthly fees. Normally, this is much easier and you will lower to help you combine debt your self having an unsecured loan from a financial or a reduced-attract mastercard.

Version of Debt consolidation reduction Financing

In fact it is right for you will depend on the new conditions and you will sorts of your finance as well as your latest financial predicament.

There’s two wider type of debt consolidation loans: secure and you can signature loans. Secured finance is actually supported by a secured item just like your family, and that serves as guarantee into financing.

Unsecured loans, on the other hand, are not backed by assets and can be much more tough to get. Nevertheless they generally have highest rates minimizing being qualified quantity. Which have often types of financing, interest levels are nevertheless generally speaking less than the fresh new prices recharged for the playing cards. online personal loans Hawai And often, the rates try fixed, so they really wouldn’t increase along the fees period.

That have any type of mortgage, you need to prioritize and this of expenses to settle first. They tend to is reasonable before everything else the highest-attract loans and really works your way down the number.

Signature loans

A consumer loan are a personal bank loan away from a bank otherwise borrowing from the bank union that give a lump sum you need for all the mission. You pay-off the mortgage that have normal monthly payments for a flat time along with a-flat interest rate.

Unsecured loans tend to have straight down rates than just handmade cards, to enable them to getting perfect for merging credit debt.

Some lenders provide debt consolidation reduction fund specifically for merging obligations. He’s designed to help individuals who are enduring numerous high-notice loans.

Playing cards

As stated prior to, some credit cards promote a basic period having 0% Annual percentage rate when you transfer your balance on it. These types of advertising attacks tend to history off six so you can 21 days otherwise thus, following the speed is shoot up into twice digits. So it’s better to pay back your debts, otherwise as often of it as you are able to, as soon as possible.

Remember that these types of cards may impose a first commission, usually equal to step three% to 5% of your own amount youre mobile.

Family Collateral Finance

When you are a resident who may have gathered security more than many years, a house equity mortgage otherwise household security credit line (HELOC) might be a helpful cure for combine obligations. This type of secured finance make use of your security as the equity and you can usually offer rates of interest slightly significantly more than mediocre home loan pricing, which are often better below credit card rates of interest.

To purchase your copy regarding Investopedia’s How to proceed With $10,000 mag for more recommendations on controlling personal debt and you will strengthening borrowing.

Student loans

Government entities also provides numerous consolidation alternatives for those with student finance, and additionally head combination financing through the Federal Direct Financing Program. Brand new interest rate ’s the adjusted average of your earlier in the day fund. Combining their federal college loans can result in all the way down monthly payments of the stretching out this new repayment period in order to provided 31 decades. But not, that and additionally indicate paying alot more overall focus over the long lasting.

Debt consolidation reduction and your Credit score

A debt consolidation mortgage could help your credit rating on the long haul. Through the elimination of your monthly payments, you need to be in a position to spend the money for mortgage away from sooner and you can reduce your borrowing usage proportion (how much money you borrowed from at a time opposed on the complete quantity of debt you have access to). It, therefore, might help increase credit score, causing you to prone to become approved of the financial institutions and for ideal costs.

]]>