Finest Totally free good to go online slot Revolves Incentives No-deposit Uk Casinos 2024

3. Dezember 2024EuroGrand Local casino 2021: soccer safari play A comprehensive Remark

3. Dezember 2024You could deposit but not much we want to initiate investing the stock market. SoFi Invest try a powerful replacement Robinhood, and it is actually the system I personally use for the majority of of my individual using. Such as Robinhood, SoFi also offers commission-free exchange of carries and ETFs without account minimums.

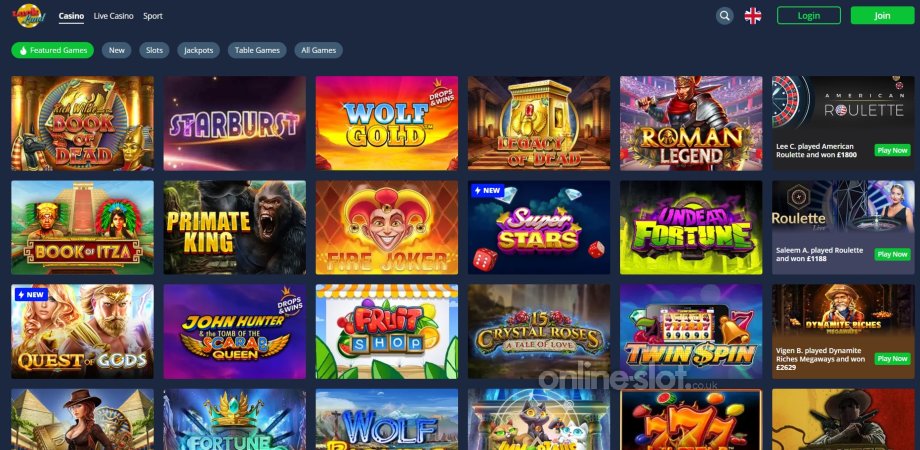

RobinRoo Casino Customer service

You’ll get access to 5,000-fifty,100000, according to your bank account equilibrium at that time you create an excellent put into the Robinhood account. I observed the brand new crypto rates had been higher than to your Coinbase and you can almost every other crypto exchanges which i have fun with, and i nonetheless don’t excessively learn crypto costs charged because of the Robinhood. If charges have been far more transparent to own crypto, Robinhood will be my go-so you can program, while the recurring purchases without commissions ensure it is a good option. You might quickly navigate thanks to IPOs through the software because of the looking “IPO Access” from the search eating plan, and choose “I’yards curious” if you learn one to you adore. The advantage of IPO accessibility try to purchase offers from the listed rates, and that (ideally) is gloomier than the trade speed immediately after launch, however, carries chance.

Robinhood brings IRAs of these seeking to build much time-name wealth because of a retirement membership. The fresh investment programs render antique and you may Roth IRAs, that have profits-totally free investments, demanded portfolios, or over in order to a step threepercent match on every buck you to visits the IRA. J.P. Morgan Notice-Led Investing also provides on the internet fee-free trade away from holds and you may ETFs and also the ability in order to exchange choices and you will mutual money, the second at which Robinhood will not offer.

IPO Accessibility

You could see APY said to have a bank account or a great certification of put (CD) because the creditors should emphasize the most you stand to earn. One restrict out of APY is the fact they doesn’t take into account costs or charge your account get sustain. In general, the fresh APY will be more than the new Apr for a passing fancy membership, whether it have compounding attention and you may low or no fees. You to disadvantage of Apr would be the fact they doesn’t look at the outcomes of compounding.

The platform now offers IRAs which have around a good step 3percent match for every money your subscribe to an excellent Robinhood IRA. Only Robinhood Silver players gain access to the highest fits incentive. Robinhood1 also provides an easy financing platform making it simple for anyone to change. If you ask me, the platform is a strong choice for the fresh people who want so you can exchange holds, ETFs, options2, or crypto without having to pay just one penny in the profits. Its associate-friendly cellular software no account minimums create participating in the brand new business easy, even when you are strict for the bucks.

Options transactions are usually cutting-edge and may also include the chance of dropping the whole money inside the a comparatively short time. Particular advanced options tips carry a lot more risk, including the potential for loss that may https://happy-gambler.com/super-flip/real-money/ meet or exceed the first financing matter. Focus are made for the uninvested bucks swept from the broker membership to help you system banking institutions. To own margin permitted users, to earn attention through the dollars brush system, a funds harmony is necessary.

You’ll get verification in the app in case your cards is successfully affirmed and able to explore. Next, we will briefly fees step one.95 on the financial to ensure the debit card. We remind one bring special care to enter this information correctly, and one leading or at the rear of zeroes in both the new membership and routing number. Their paying account includes a good Robinhood Dollars Cards, that can get to the newest send. Although not, you should buy become immediately by activating their Robinhood Cash Credit from the software and you will funding your account which have funds from a connected savings account. The new Robinhood Cash Cards is recognized by the very retailers one accept Charge card.

Brings and you may Fund

Add to one to Robinhood’s minimal step one financing and also the capability to purchase fractional offers from ETFs and they are among the better possessions to the platform. Robinhood is continuing to grow steadily within the dominance in recent years, however it’s a bad program for everyone. Robinhood try seemingly perfect for those trying to explore stock deals, exchange-traded finance (ETFs), and crypto change, all the using one platform. It’s a simple-to-explore cellular software and you can commission-free provider, which is appear to rated as one of the best on line agents. This article is educational, which is not an offer to offer otherwise a solicitation out of a deal to find people security.

Instant bank import – put option enables you to deposit funds from your own bank to the Robinhood account in minutes as opposed to days with no costs. Robinhood might have been definitely diversifying its crypto products and you may merchandising individual portfolios in 2010. The firm gotten Pluto Money, a good crypto and you can artificial intelligence research program, as well as the change system Bitstamp. Both moves were aimed at broadening Robinhood’s worldwide crypto visibility and drawing institutional members due to new product products. Availableness such titles to the Screen, 7 monkeys step one put Android os, apple’s ios, or other systems with casino apps otherwise gamble because of sites internet browsers.

Using membership

Robo-advisers and online broker accounts can make paying simple. An informed applications give diversification, a range of account versions, and considered equipment in order to make use of your own money. I is these types of items once we speed spending apps and profile. The list of available cryptocurrencies is a lot smaller than you can find from the a real crypto broker, but it’s among the prominent selections of one trading software i remark. Robinhood only also provides crypto exchange inside the nonexempt broker account — perhaps not inside the IRAs.

There is an automatic teller machine withdrawal restrict away from 510 per day and you can 5,000 monthly. Customers have access to a vast Atm network with over 75,000 ATMs. However, you will be charged a great 2.50 fee for everyone Automatic teller machine withdrawals if you don’t provides at least three hundred in direct deposits inside a rolling 34-date screen.