You’ve checked finally discovered a property to shop for. But now, your own lender sets you an excellent curveball and requires that you pay having Personal Financial Insurance policies (PMI). Very, what exactly is PMI precisely?

Individual home loan insurance policies (PMI) covers the lending company financially if you avoid and make payments and you may standard in your home loan. The insurance coverage is purchased by the lending company from the closure, with the will cost you died to you personally as part of your monthly mortgage payment.

While it is intended to cover the lender, PMI superior manage offer specific advantageous assets to you once the a debtor. There are even methods do away with the degree of PMI you prefer, avoid purchasing PMI completely, otherwise lose PMI after you have ordered your house. Let’s search into the.

Why you need to pay for PMI

Loan providers usually want PMI for antique loan borrowers just who generate an effective down payment that’s below 20% of one’s residence’s price. Therefore, what if you purchase a home having $250,000. A down-payment out of less than $fifty,000 form you are going to have to pay PMI.

Exactly why do lenders need PMI within condition? While they check consumers which have below 20% security in their house just like the a heightened exposure than those which have 20% or higher. Needed some form of insurance coverage having individuals whom We covers the lending company should you decide default on the loan.

How will you spend PMI

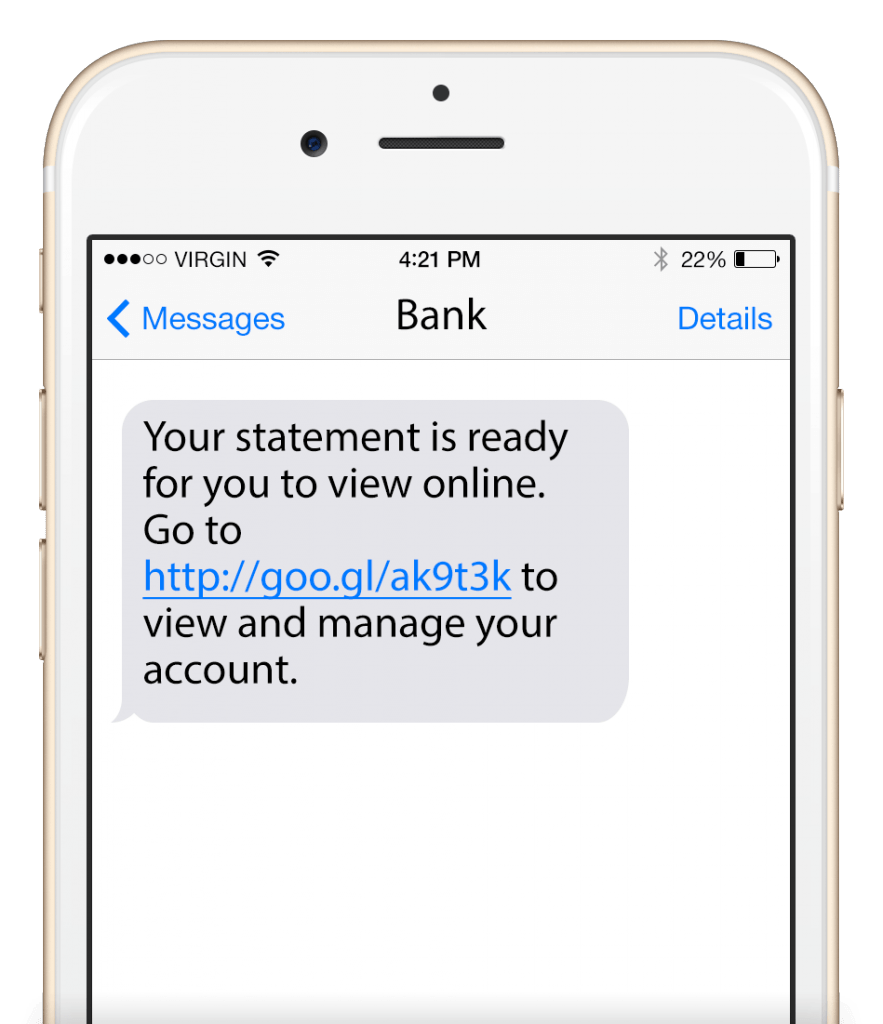

Your home loan company allow you to determine if you happen to be expected to pay for PMI. They’re going to and manage the fresh new legwork regarding organizing a policy which have an insurer of the choices. As the PMI cost is well known (more info on that it below), the lender can add on the brand new commission count straight to the home loan. You may then spend the money for PMI advanced in your month-to-month homeloan payment.

The financial institution We superior in full, in your closing costs. Although this adds somewhat for the initial cost of buying a beneficial house, they usually leads to a reduced full PMI superior.

Yet another choice is known as financial-paid off PMI (LPMI). Using this type of, the lender pays the fresh new PMI superior but costs you an excellent higher interest to your financing.

The expense away from PMI

As with whichever brand of insurance coverage product, the cost of PMI may vary ranging from insurance vendors and you will changes more big date considering industry forces. The price in addition to depends on one or two key factors individually linked to your as the a borrower.

- The loan-to-really worth (LTV) ratio. This might be a means of stating their collateral in your home. If one makes a beneficial 10% down payment, the LTV proportion is actually 90%. If you make good 3.5% deposit, the LTV ratio are 96.5%. Essentially, increased LTV proportion (a lowered down-payment) often drive your own PMI can cost you highest.

- Your credit score. Investing costs on time and having almost every other responsible borrowing from the bank habits is to produce a higher credit rating. It should also lead insurance companies to consider you less chance to help you default on your own mortgage, which in turn will help lower your PMI can cost you.

Considering Experian, PMI essentially costs around 0.2% so you can dos% of your own amount borrowed a year. Once more, this type of will set you back vary according to research by the issues explained over.

Is a quick example: You order a great $250,000 house or apartment with a great $twenty five,000 deposit (10%). The first amount borrowed was for this reason $225,000. Predicated on your own LTV proportion, credit rating, or other facts novel in order to a borrower, what if the newest PMI premium was step one% of your loan amount. So, the annual PMI cost was $225,000 x .01 = $2,250. This really is broke up similarly certainly one of the 12 monthly home loan repayments, which means you shell out $ four weeks to possess PMI also the prominent and you can interest costs.